Please find below a pdf file containing the TDS rates and limits applicable for FY 2022-23/ AY 2023-24.

How to deal with the assessment order passed levying huge tax liabilities, interest and penalty?

Huge add-backs in assessment order? An exemption claim not given? Taxes and interest computed erroneously? Should we file an appeal or not? Penalty order received – wondering what to reply? The order passed in not just and fair?

Are any of these worrying you?

Don’t panic with the huge add-backs, taxes, interest, or penalties raised. Many times orders are passed without considering the facts and law in detail. Many facts and aspects of the law are hidden and if not appropriately pointed out before the tax authorities could lead to orders that are prejudicial to one’s interest. There is more than one remedy available to the taxpayer based on the type of order.

Assessment orders

The orders passed levying huge taxes, interest, etc. could be broadly on account of two reasons:

- Computational errors.

- Disputed issues at hand.

- Computational errors – If the order passed has a mistake that is apparent on record the taxpayer can file a rectification application u/s 154 for the same and need not go for an appeal if there are no disputed issues at hand.

A mistake apparent on record means any mistake which is obvious and patent. The plain meaning of the word “apparent” is that it must be something that appears to be so ex-facie and is incapable of argument or debate. It could be factual errors, mathematical errors, clerical errors, and involuntarily overlooking certain compulsory legal provisions. E.g., the tax percentage taken is erroneous, interest is not computed as per the provisions of the Act, TDS credit has not been given, taxes paid are not considered, deduction, allowance, or relief which is accepted by the officer but overlooked while computing, etc.

Against such mistakes, a rectification application can be filed online u/s 154 and relief be claimed for erroneous computations in the assessment order.

- Disputed issues at hand – if there are issues in the assessment order which are disputed, the remedy in the hands of the taxpayer is to file an appeal with the Commissioner of Appeal in Form 35 within 30 days from the passing of the order. However, for reasons beyond control, an appeal can be filed even after 30 days by filing a condonation of delay application.

How to judge whether one should go for an appeal or not?

The usual errors while passing the Assessment order which could give scope for a good argument and become a significant point in the appeal are as below:

- The order was not passed within the time limit prescribed under the Income Tax Act.

- The order was passed without giving a proper opportunity of being heard.

- Where e- submissions couldn’t be made for technical glitches in portal.

- The video conferencing option requested was not granted.

- The order was passed without giving a prior show cause notice to submit documents or evidence supporting the issues raised by the Assessing Officer.

- The order has been passed by the assessing officer ignoring the facts and documents submitted before them.

- The order passed does not clearly pronounce the issue at hand and has just added back income as unexplained.

- The issue at hand has two opinions and a favorable opinion has been ignored.

- Binding judicial precedents have not been considered while passing the order.

- Additional evidences are present which could not be submitted before the Assessing officer but are crucial in deciding the case at hand.

- Recent amendments/notifications/circulars have not been considered while passing the order.

There could be many such issues, one must take expert advice before filing an appeal to decide whether it’s a fit case to proceed or not.

Form 35 – Crucial Points to be considered

- Prepare a brief Statement of facts covering all facts of the case and also state the facts that are ignored by the assessing officer

- Grounds of appeal – this should ideally cover all the objections raised both from a law and facts perspective with quoting of sections wherever applicable.

- 20% of the disputed demand needs to be paid upfront at the time of filing an appeal.

- Appeal filing fee needs to be remitted before uploading the Form 35.

- Additional evidences if any, which were not submitted before the Assessing officer needs to be mentioned in the statement of facts and in Form 35.

- If an appeal is not filed within the time limit, a condonation application is to be enclosed.

Though the form 35 is available on the portal and one can directly file an appeal, it is always advisable to take professional support as there are many precautions that need to be exercised to avoid further issues while representing the case.

Penalty orders

The penalty orders received need to be responded to within the time limit otherwise huge penalty would be levied. Penalty could be for various reasons such as not filing of returns, non-audit of books of accounts, default in TDS/TCS remittances if income has escaped assessment or contravention of loan provisions etc.

The penal provisions under the Act are very stringent, but irrespective of it the taxpayer will be given an adequate chance to represent and submit all documents and evidence so as to justify why the penalty should not be received.

One should clearly see which section is applicable and what are the conditions to levy penalty under that section. Based on the facts and law one can represent why the penalty should not be levied. Further in cases of genuine hardship caused to the taxpayer one can try to reduce the penalty amount by taking the support of many judicial precedents.

Conclusion

One should not panic looking at the orders passed and taxes levied. Instead, patiently look for points both factually and legally which could justify and get the rightful claim to you. There are various remedies available at the hand of a taxpayer. One needs to exercise the options at the right time and in the right manner to protect their interest.

EXTENSION OF TIME LIMITS OF CERTAIN COMPLIANCES UNDER INCOME TAX ACT- REF CIRCULAR NO.9/2021 DATED 20TH MAY 2021.

The Central Board of Direct Taxes, in the exercise of its power under section 119 of the Income-tax Act, 1961 (hereinafter referred to as “the Act”) provides relaxation in respect of the following compliances:

- The Statement of Financial Transactions (SFT) for the Financial Year 202021, required to be furnished on or before 31st May 2021 under Rule 114E of the Income-tax Rules, 1962 (hereinafter referred to as “the Rules”) and various notifications issued thereunder, may be furnished on or before 30th June 2021;

- The Statement of Reportable Account for the calendar year 2020, required to be furnished on or before 31st May 2021 under Rule 114G of the Rules, may be furnished on or before 30th June 2021;

- The Statement of Deduction of Tax for the last quarter of the Financial Year 2020-21, required to be furnished on or before 31st May 2021 under Rule 31A of the Rules, may be furnished on or before 30th June 2021;

- The Certificate of Tax Deducted at Source in Form No 16, required to be furnished to the employee by 15th June 2021 under Rule 31 of the Rules, may be furnished on or before 15th July 2021;

- The TDS/TCS Book Adjustment Statement in Form No 24G for the month of May 2021, required to be furnished on or before 15th June 2021 under Rule 30 and Rule 37CA of the Rules, may be furnished on or before 30th June 2021;

- The Statement of Deduction of Tax from contributions paid by the trustees of an approved superannuation fund for the Financial Year 2020-21, required to be sent on or before 31st May 2021 under Rule 33 of the Rules, may be sent on or before 30th June 2021;

- The Statement of Income paid or credited by an investment fund to its unit holder in Form No 64D for the Previous Year 2020-21, required to be furnished on or before 15th June 2021 under Rule 12CB of the Rules, may be furnished on or before 30th June 2021;

- The Statement of Income paid or credited by an investment fund to its unit holder in Form No 64C for the Previous Year 2020-21, required to be furnished on or before 30th June 2021 under Rule 12CB of the Rules, may be furnished on or before 15th July 2021;

- The due date of furnishing of Return of Income for the Assessment Year 2021-22, which is 31st July 2021 under sub-section (1) of section 139 of the Act, is extended to 30th September 2021;

- The due date of furnishing of Report of Audit under any provision of the Act for the Previous Year 2020-21, which is 30th September 2021, is extended to 31st October 2021;

- The due date of furnishing Report from an Accountant by persons entering into international transaction or specified domestic transaction under section 92E of the Act for the Previous Year 2020-21, which is 31st October 2021, is extended to 30th November 2021;

- The due date of furnishing of Return of Income for the Assessment Year 2021-22, which is 31st October 2021 under sub-section (1) of section 139 of the Act, is extended to 30th November 2021;

- The due date of furnishing of Return of Income for the Assessment Year 2021-22, which is 30th November 2021 under sub-section (1) of section 139 of the Act, is extended to 31st December 2021;

- The due date of furnishing of Return of Income for the Assessment Year 2021-22, which is 30th November 2021 under sub-section (1) of section 139 of the Act, is extended to 31st December 2021;

Clarification 1: It is clarified that the extension of the dates as referred to in clauses (9), (12) and (13) above shall not apply to Explanation 1 to section 234A of the Act, in cases where the amount of tax on the total income as reduced by the amount as specified in clauses (i) to (vi) of sub-section (1) of that section exceeds one lakh rupees.

Clarification 2: For the purpose of Clarification 1, in case of an individual resident in India referred to in sub-section (2) of section 207 of the Act, the tax paid by him under section 140A of the Act within the due date (without extension under this Circular) provided in that Act, shall be deemed to be the advance tax.

TDS RATES FY 2021-22

Please find below a pdf file containing the TDS rates and limits applicable for FY 2021-22 /AY 2022-23.

HUF – Tax Planning Tool

What is Hindu Undivided family?

Hindu undivided family (HUF) is a Joint Hindu family with common ancestors. The Hindu Succession Act, defines a HUF, as a family of persons lineally descended from a common ancestor and related to each other by birth or marriage.

In other words, three conditions need to be satisfied:

- Must be a Hindu. The word Hindu for the purpose of having a HUF is construed liberally and includes Jains, Sikh, and Buddhists.

- There should be a family i.e. a group of persons.

- Have common ancestors among them.

Who can be the Karta, Coparcener or a Member of an HUF?

Karta is the person who manages or represents the HUF and is generally the senior-most male member of the family. Only a Co-parcener can become the Karta of HUF.

Any person (male or female) born in a Joint Hindu family who is within four degrees in lineal descendent from the common male ancestor is considered as a coparcener and anyone who becomes part of the family by virtue of marriage is treated as a member. However, a person who is adopted into the family also becomes its coparcener from adoption though not born in the family. As per the amended law since 2005, even a girl child becomes a coparcener by birth and can continue to be a co-parcener of her father’s HUF even after her marriage. However, she will only be a member of her husband’s HUF.

Co-parceners have a right to seek partition and become the Karta of the HUF. Whereas, Members have the right to be maintained out of the funds of HUF, and receive their share at the time of partition but do not have the right to seek for partition or become the Karta.

How taxed under Income tax Act.

The Income-tax Act recognizes such family as a separate entity. The definition of ‘person’ under section 2(31) of the Income Tax Act 1961 includes HUF as a separate person having its own status, distinct from any individual, firm, company, etc. A HUF is created by the operation of law and therefore cannot be created by the actions of a person.

How to create a HUF

HUF comes into existence automatically at the time of marriage. It is created through executing a deed, obtaining PAN, and applying for a bank account. The various source of its assets could be:

- By way of gift

- By Will

- Common Ancestral property

- Property acquired from the sale of joint family property

- Property contributed to the common pool by members of HUF.

Note: To ensure personal assets or funds are not transferred to HUF account as income generated from such assets/funds will attract clubbing provisions.

How creating of HUF helps save tax legally

HUF is considered a separate legal entity as per law and hence has its own PAN and files tax returns independent of its members. By forming a HUF, one can optimize their tax liabilities and also include their family members to benefit in the future. The various advantages are:

- Deductions and exemptions

A HUF is taxed at slab rates – the same rate as that of an individual and is eligible for a basic tax exemption limit of Rs 2,50,000.

HUF is also separately eligible for various deductions under section 80 such as:

- Deductions for specified investments under section 80C in LIC, PPF, NSC, etc., up to Rs 1,50,000 every year.

- Mediclaim for its family members under section 80D up to Rs 30,000.

- Interest on savings accounts u/s 80TTA up to Rs 10,000.

Thus, total deduction of Rs 1,90,000 could be availed by the HUF irrespective of its individual member deductions.

Further specific deductions on medical treatment/expenditure of disabled or dependent family members, donations to charity, etc can be availed based on the amount spent for the said purposes.

- House property benefits

- Rental income could be received on behalf of HUF, instead of the individual account.

- The HUF is also entitled to claim a deduction for interest on self-occupied house property of Rs. 2,00,000 in a year.

- If residential house property is purchased by the HUF, the home loan interest paid and repayment of the loan can be claimed as a deduction.

- The HUF can also let out its property to any person and interest on loan paid deduction can be availed without any limit, in respect of the said property.

- Business income

The HUF can carry on certain family business like any other entity:

- Profits generated out of the family business, in the name of a HUF, shall be taxed accordingly and exemptions will give more leverage on tax saving.

- It can pay remuneration to Karta and other family members.

- Can give loans to its members

- Investments and capital gain exemptions

The HUF is permitted to invest in various tax-free instruments. Also, it can avail specific capital gain exemptions under sections 54, 54B, 54F, 54EC, etc., and optimize its tax liabilities for the benefit of the entire family.

- Family Settlement or Arrangement:

The sole purpose of the family settlement should be to settle existing or future disputes regarding property, amongst the members of the family. Since this arrangement does not involve the transfer, it would not attract gift tax, capital gains tax, or clubbing. In a family arrangement, tax incidence is considerably reduced or it may even become nil.

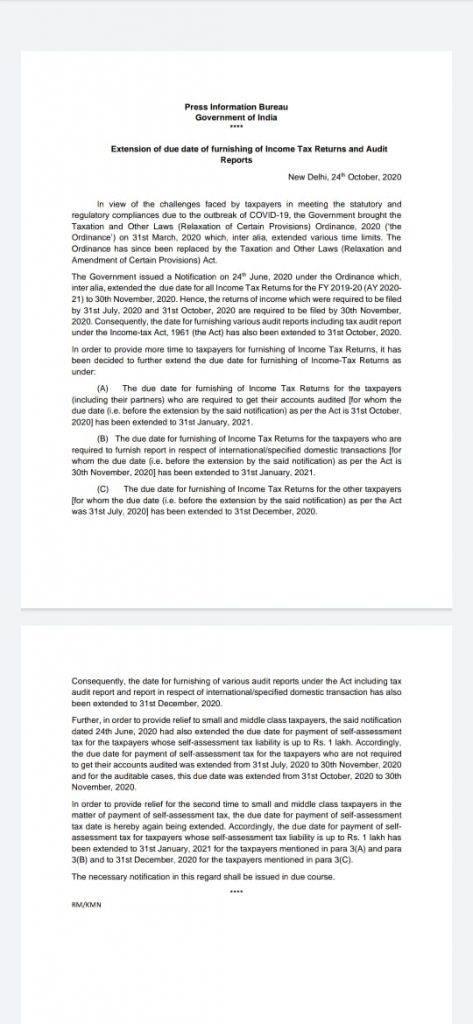

Extension of Income Tax filing due date for FY 2019-20

1. The due date for furnishing of Income Tax Returns for taxpayers (including their partners) who are required to get their accounts audited [for whom the due date (i.e. before the extension by new notification) as per Income Tax Act is 31 Oct 2020] is extended to 31 Jan 2021.

2. The due date for furnishing audit reports including tax audit report & report in respect of international/specified domestic transaction extended to 31 Dec 2020.

3. The date for payment of self-assessment tax for those with self-assessment tax liability of upto Rs.1 lakh extended to 31 Jan 2021.

4. The due date for furnishing of Income Tax Returns for the other taxpayers [for whom the due date (i.e. before the extension by the said notification) as per the Act was 31 July, 2020] has been extended to 31 December 2020.

Source: Press Information Bureau

Selling a House – Possible tax implications.

A well-planned sale of property could save you from hefty taxes. The first and foremost critical aspect while selling a house to be kept in mind is the time for which the property has been held. The period of holding determines the benefits that are available and the exemptions that can be utilized to eventually determine the tax outflow.

Property held for less than two years – tax implications

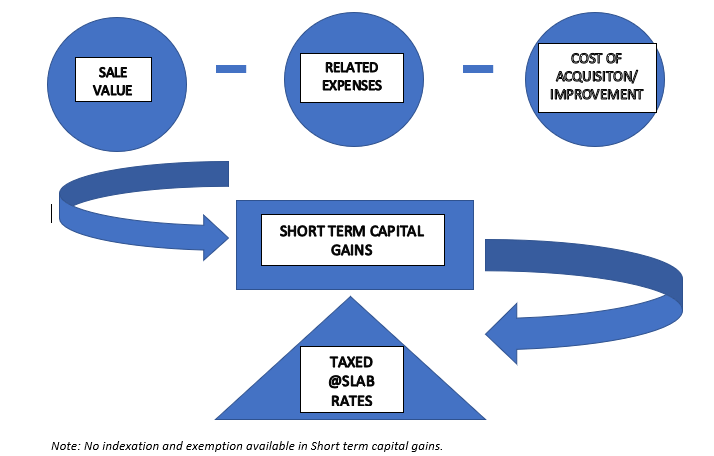

The sale value of the property, reduced by related sale expenses and cost of acquisition or improvement incurred is the resultant capital gains earned from the property. Such profit earned from the property which is held for less than two years will be subject to Short Term Capital Gains (STCG). The STCG on sale of the property is added to the total income of the seller and is taxed at normal slab rates applicable to such an individual. To understand better, those earning more than 10 lakhs a year would shell out 30% tax on such profits from the sale of property. Neither benefit of inflation index can be taken, nor any exemption for the investment of the profits be utilized to reduce the tax burden.

Property held for more than two years – tax implications

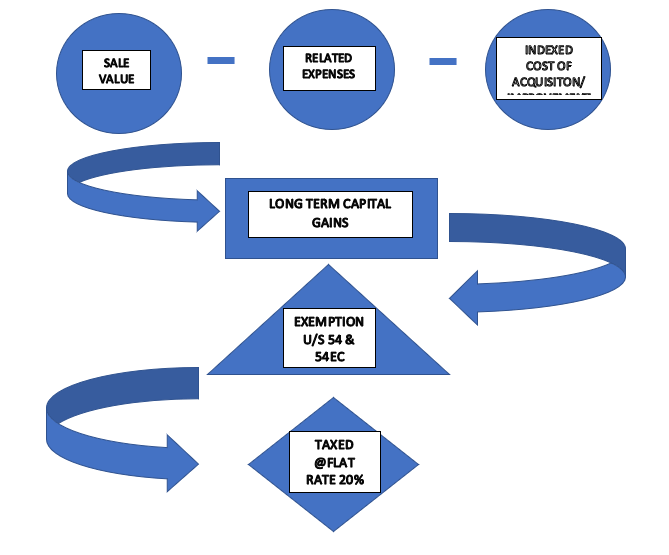

On the other side if the property is held for a period beyond two years the profit would be subject to tax at a flat rate of 20% after indexation. While computing such profits, the cost inflation indexation benefit would be given for the period held. Indexation takes into account the inflation for the period held and thereby adjusting the cost of acquisition.

Also, in case of longterm capital gains the seller can avail the various investment options available and claim exemption from payment of taxes. The various re-investment options available are as follows:

- Section 54 -Buy/ construct another house property

- Section 54 EC – Invest in specified Government Bonds

Exemptions and conditions

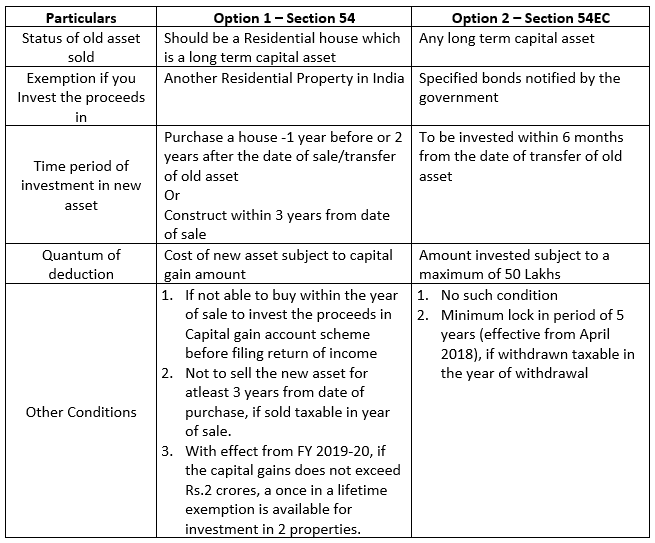

There are two exemptions which can be utilized by the person selling a house property to save himself from hefty taxes, they are as follows:

How is a private family trust taxed in India

The Indian Trust Act, 1882, governs a Private Trust. Private trust is a vehicle through which property can be transferred from one person (owner) to another for the benefit of an individual or an ascertainable group of people.

A private trust is created for the benefit of specific individuals i.e., individuals who are defined and ascertained individuals or who within a definite time can be definitely ascertained. A family trust set up to benefit members of a family is the most common purpose for a private trust. The purpose of the family trust is for the settlor to progressively transfer his assets to the trust, so that legally the settlor owns no assets himself, but through the trust, beneficiaries get the benefit of these assets.

Private trusts can act an effective estate planning tool if you have a special child, a large business to be transferred to the next generation or a large estate to protect. Although the formation of a private trust resolves many issues, a lot needs to be considered in making a private trust, especially from the taxation point of view. As the income of a trust is taxed differently in different structures, careful planning is required to reap benefits without draining much money in the form of income-tax.

As the income of a private trust is available only to the beneficiaries, taxation is carried out according to the structure in which the income has been received.

From tax point of view, there are two structures under which the income of a private trust is taxed:

Specific trust: Here the income is received by the representative assesses on behalf of a single beneficiary. As the individual share of the beneficiary is known, taxation is done accordingly. For instance, it should be clearly stated in the trust deed that XYZ would get 50 per cent of the total income of the trust or the author’s son will draw the entire benefits from the trust.

Discretionary trust: With more than one beneficiaries, the individual shares are not known. Here the income of the trust is not received by a representative but determined by the trustees.

Taxability of Private Specific/Determinate Trust.

- Status of the Trust –would take the same status as the beneficiaries to the extent of their share

- Residential status of the Trust –would take the same status as the beneficiaries to the extent of their share

- Taxability in the hands of the Trustee or beneficiary? –in so far as the private non-discretionary trust is concerned, the shares of the real owners of the income i.e. the beneficiaries is known and therefore, the income can be taxed either in the hands of the beneficiaries directly or in the hands of the trustees in their capacity of representative assessee. However, there would be no double taxation. This has been clarified by the Board in Circular No. 157 dt. 26.12.1974.

- Taxability in the hands of the trustee – in a representative capacity u/s 161(1) r.w.s. 160 of the Act. Tax shall be levied upon and recovered from him in like manner and to the same extent as it would be leviable upon and recoverable from the person represented by him.

The Supreme Court in case of Nizams (supra) has held that

“It is also necessary to notice the consequences that seem to flow from the proposition laid down in s. 21, sub-s. (1), that the trustee is assessable” in the like manner and to the same extent “as the beneficiary. The consequences are three-fold. In the first place, it follows inevitably from this proposition that there would have to be as many assessments on the trustee as there are beneficiaries with determinate and known shares, though, for the sake of convenience, there may be only one assessment order specifying separately the tax due in respect of the wealth of each beneficiary. Secondly, the assessment of the trustee would have to be made in the same status as that of the beneficiary whose interest is sought to be taxed in the hands of the trustee….And, lastly, the amount of tax payable by the trustee would be the same as that payable by each beneficiary in respect of his beneficial interest, if he were assessed directly.”

- Benefits available –All the benefits, deductions or allowances which an individual beneficiary could have obtained are also available to the trustees assessed in representative capacity– for instance benefit u/s 54 of the Act. (See 237 ITR 82 (Bom) Mrs. Amy P. Cama, Trustee of the Estate of Late M. R. Adenwalla v. CIT)

- Rate of tax –If taxable in hands of the beneficiaries then the normal rates applicable to the beneficiaries. Similar position to apply even if tax recovered from the Trustee in representative capacity. Section 161(1A) states that, where the income consists of any profits or gains of business, then the same is to be taxed at MMR, subject to certain exception. Further, special rates as are applicable to special category of income like long term capital gain would continue to apply. [See in favour – Mahindra & Mahindra Employees’ Stock Option Trust [2015] 44 ITR(T) 658 (Mumbai – Trib.), Jamsetji Tata Trust v. JCIT [2014] 148 ITD 388 (Mumbai – Trib.). Against – DCIT v. India Cements Educational Society [2016] 46 ITR(T) 80 (Chennai – Trib.) and Companies Incorporated in Mauritius, In re [1997] 224 ITR 473 (AAR)]

Taxability of Private Discretionary Trust.

- Status of the Trust –would take the same status as the beneficiaries since the representative assessee has to be taxed in the like manner and to the same extent as per section 161 [See the judgment of the Apex Court in case of CIT v. Smt. Kamalini Khatau – 209 ITR 101(SC)]. Therefore, if all the beneficiary are of same status i.e. either individual or company etc. then the trustees would take the same status.

However, if the beneficiaries are carrying different status, then the status of the trustees cannot be determined. In such cases, the Courts have held that the trustees should be taken an assessable unit liable to be taxed as an individual (as discussed above).

Proviso to section 164(1) states that, in certain cases tax would be leviable as if it were the total income of an AOP. Proviso to section 164(1) only lays down that the rate of AOP would apply and it cannot be inferred therefrom that the trust would be considered as an AOP.

- Residential status of the Trust –would take the same status as the beneficiaries. If all are resident, the Trustees would be treated as a resident and vice versa. However, in case where some of the beneficiaries are resident and some are not, then determination of the residential status of the trustees is a grey area with no reasonable certainty. Though there are opinions to the effect that the residential status of the trustees would be taken into consideration, however, there is no or less legal backing.

- Taxability in the hands of the Trustee or beneficiary –

In so far as the private non-discretionary trust is concerned, the shares of the real owners of the income i.e. the beneficiaries is not known. Where the income of the trust accruing in a particular year is not distributed amongst the beneficiaries, one would not be aware about the income of any particular beneficiary. In such a case, the tax has to be paid by the trustee in representative capacity u/s 164(1).

In case where the income has been distributed to the beneficiaries, tax can be recovered from the trustee u/s 164(1). Further, in such cases, the Courts have held that the tax can be recovered from the beneficiaries also.

However, as already specified earlier there cannot be any double taxation.

- Taxability in the hands of the trustee –in a representative capacity u/s 161(1) r.w.s. 160 of the Act. Tax shall be levied upon and recovered from him in like manner and to the same extent as it would be leviable upon and recoverable from the person represented by him.

- Benefits available – it will be difficult to argue that all the benefits available to the individual would be available to the trustee, unless any specific condition to claim the deduction etc. has been fulfilled on behalf of any specific beneficiary. However, since the trustee would be assessable as individual, all benefits so available to an individual would be available to the trustee.

- Rate of tax –

Section 164(1) states that the income of an indeterminate trust would be taxable at MMR. Though it uses the word ‘charge’, section 164 does not create a charge [See Kamalini Khatau (supra)].

Proviso, to section 164(1) provides for exceptions to the above rate of MMR and in case of such exceptions, the rate applicable to AOP would apply.

If tax is recovered from the beneficiaries, it is doubtful whether the rates as applicable to the beneficiaries would apply or whether MMR would apply in accordance with section 164(1).

Further, section 161(1A) which provides for taxation of business income at MMR, would equally apply in case of indeterminate trust.

Also, as discussed earlier, special rates as are applicable to special income like long term capital gain would continue to apply.

Key Points

The various points to be kept in mind for tax planning purpose while opening a family trust are as follows:

- You must refrain from carrying out any business activity from the private trust.

- Ensure that the same set of beneficiaries are not created in more than one trust.

- If the trust is for your minor child or spouse, ensure that the funds are not through father/mother or husband/wife because in that case the income will get clubbed with them.

- Make private trust 100 per cent specific beneficiary for major son or daughter so that money cannot be misused by son in future or relatives of the daughter when she gets married.

TCS on sale of Goods- Section 206C(1H) w.e.f. from 1st October 2020

- The new section 206C(1H) of the Income Tax Act, 1961 has been introduced by the Finance Act, 2020 for Tax Collection at Source(TCS) on sale of goods.

- The provisions of this sub section is applicable and notified from 1.10.2020.

- The provisions of this sub section is applicable in following circumstances:

a) It is applicable to all the sellers who are engaged in sale of goods. The term “seller” has been defined in the act.

b) The term “seller” means a person whose total sales, turnover or gross receipts from the business carried on by him exceeds Rs. 10 crores during the financial year immediately preceding financial year in which the sale of good is carried out.

c) Thus, the sellers who had a turnover/sales/gross receipts exceeding Rs. 10 crores in financial year 2019-20 will be required to collect TCS in financial year 2020-21.

d) If any person has turnover/sales/gross receipts below the above mentioned limit then it is out of scope of the term ‘seller’, meaning thereby the provision of this sub section shall not be applicable on that type of assessee.

e) The applicability criterion for TCS has to be considered & checked for every year

4. The provision of this subsection will not be applicable in the following circumstances:

- This sub section is not applicable for export of goods & goods already covered under the existing provisions i.e., 2O6C(1), 206C(IF) and 2O6C(IG) governing TCS under chapter XVII-BB of the Income Tax Act,1961.

- 206C(1) covers alcoholic liquor, tendu leaves, timber, other forest produce, scrap, coal, lignite and iron ore. 206(1F) covers motor vehicle of the value exceeding Rs.10,00,000/-. 206C(1G) covers overseas tour program package.

- This subsection is not applicable in a case where value or aggregate value of sale consideration to an entity is below or equal to Rs. 50 lakhs during the year.

- This subsection is not applicable if the buyer is Central Government / State Government / Local Authority / an Embassy / High Commission / Consulate & the representative of foreign states.

- This sub section is not applicable on import of goods.

- This sub section is not applicable on a person who is notified by Government, (nothing is notified till date)

- This subsection shall not apply if the buyer is liable to deduct TDS under any other provisions of the Act on the goods purchased by him from the seller and he has deducted such amount.

- The rate of TCS will be 0.1% of the value or aggregate value of the sale consideration if the buyer furnishes the PAN/AADHAR and in other cases it shall be considered as 1% of the value or aggregate value of the sale consideration.

- However, for financial year ending 31.03.2021, the rates of TDS and TCS are reduced to 75% and therefore the rates will be 0.075% and 0.75% respectively.

- Every person who is collecting tax at source under this sub section is required to submit a quarterly TCS return in Form 27EQ. The TCS collected by the seller will be reflected in the Form 26AS of the buyer.

- The tax is to be collected at source from the buyer at the time of receipt of the amount from the buyer towards sale consideration.

- The TCS is to be collected at the time of receipt of the sale consideration. Therefore, it will be required to keep track of the receipt of sale consideration for the bills/invoices made after 01.10.2020.

- Though the provisions is effective from 01.10.2020, for calculating the Rs.50,00,000/- limit, sales of entire financial year will have to be taken into consideration.

- The TCS has to be collected only on the figure of sale exceeding Rs.50,00,000/-.

- The TCS amount collected after every month is to be remitted to the Government by 7th of the next month.

- Though TCS is collectible on receipt basis practically it would be prudent to mention the TCS as a separate line item in the bills/invoices.

- In the context of law, even on the advances received TCS will have to be collected.