A well-planned sale of property could save you from hefty taxes. The first and foremost critical aspect while selling a house to be kept in mind is the time for which the property has been held. The period of holding determines the benefits that are available and the exemptions that can be utilized to eventually determine the tax outflow.

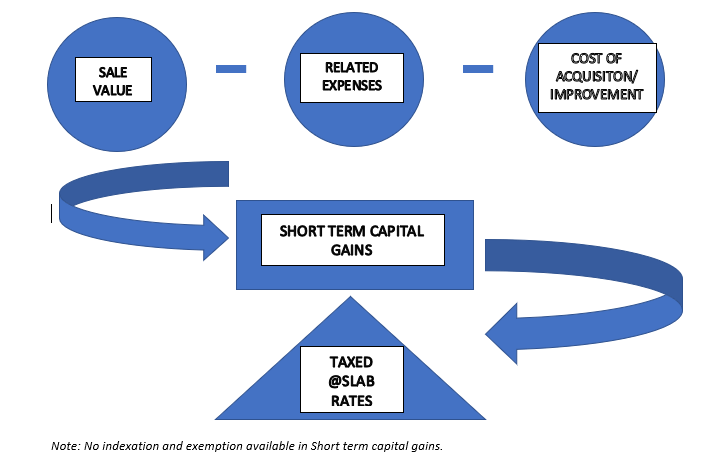

Property held for less than two years – tax implications

The sale value of the property, reduced by related sale expenses and cost of acquisition or improvement incurred is the resultant capital gains earned from the property. Such profit earned from the property which is held for less than two years will be subject to Short Term Capital Gains (STCG). The STCG on sale of the property is added to the total income of the seller and is taxed at normal slab rates applicable to such an individual. To understand better, those earning more than 10 lakhs a year would shell out 30% tax on such profits from the sale of property. Neither benefit of inflation index can be taken, nor any exemption for the investment of the profits be utilized to reduce the tax burden.

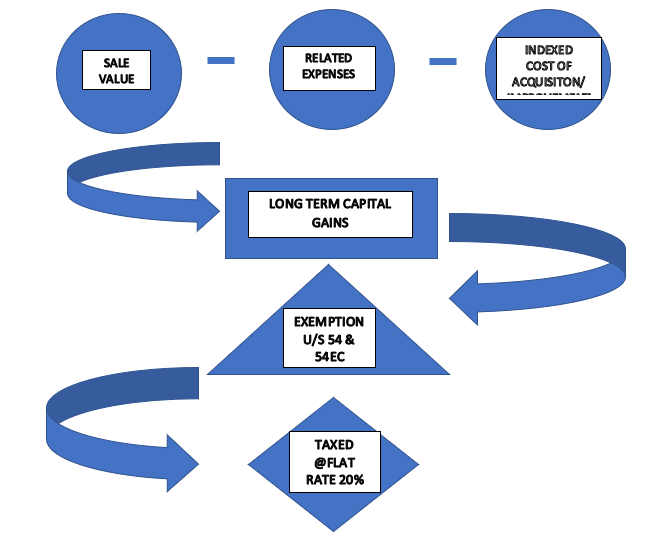

Property held for more than two years – tax implications

On the other side if the property is held for a period beyond two years the profit would be subject to tax at a flat rate of 20% after indexation. While computing such profits, the cost inflation indexation benefit would be given for the period held. Indexation takes into account the inflation for the period held and thereby adjusting the cost of acquisition.

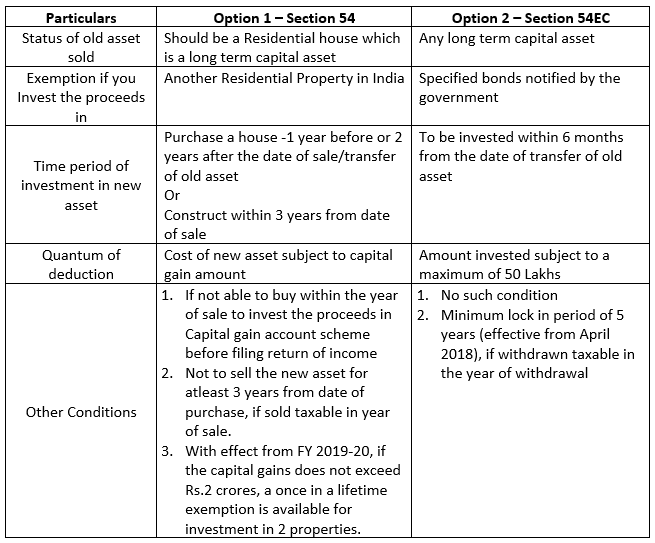

Also, in case of longterm capital gains the seller can avail the various investment options available and claim exemption from payment of taxes. The various re-investment options available are as follows:

- Section 54 -Buy/ construct another house property

- Section 54 EC – Invest in specified Government Bonds

Exemptions and conditions

There are two exemptions which can be utilized by the person selling a house property to save himself from hefty taxes, they are as follows: