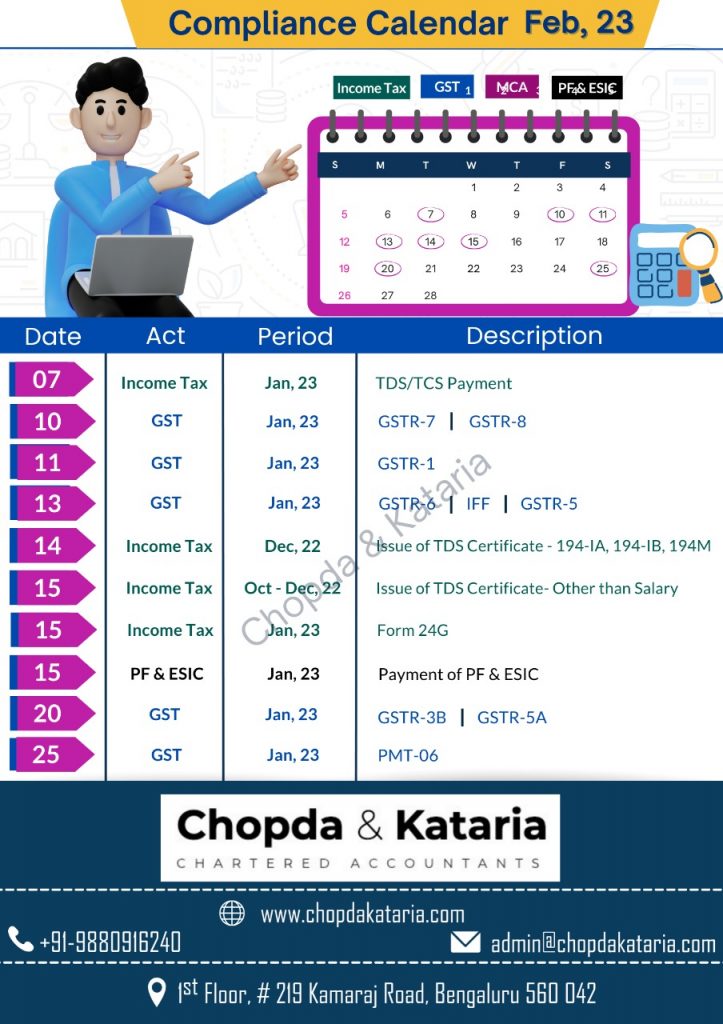

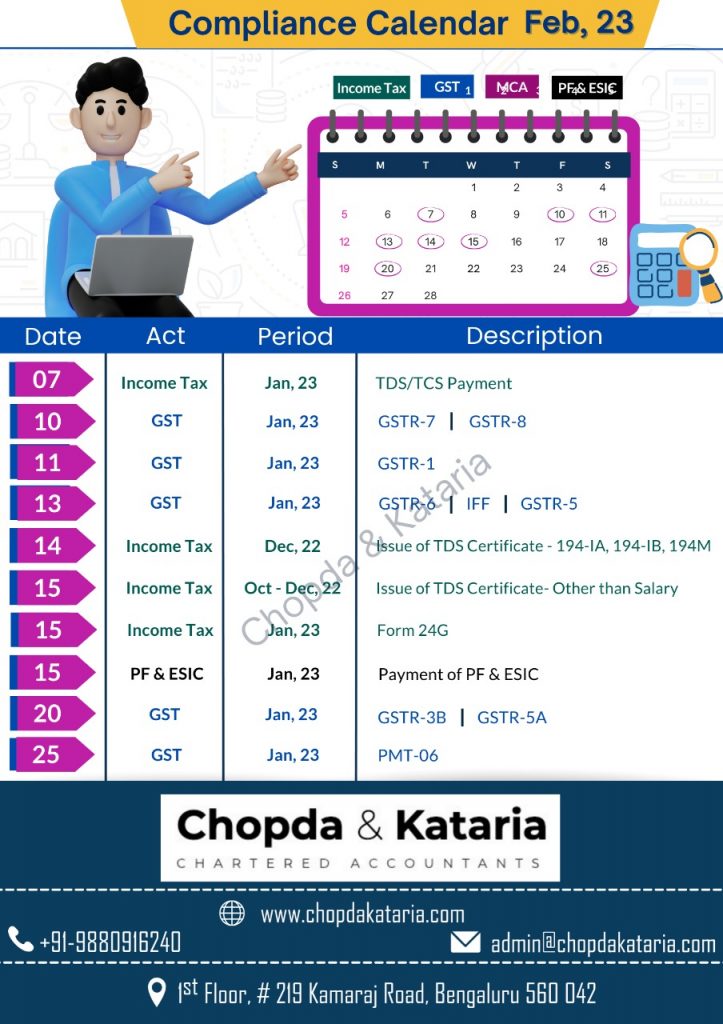

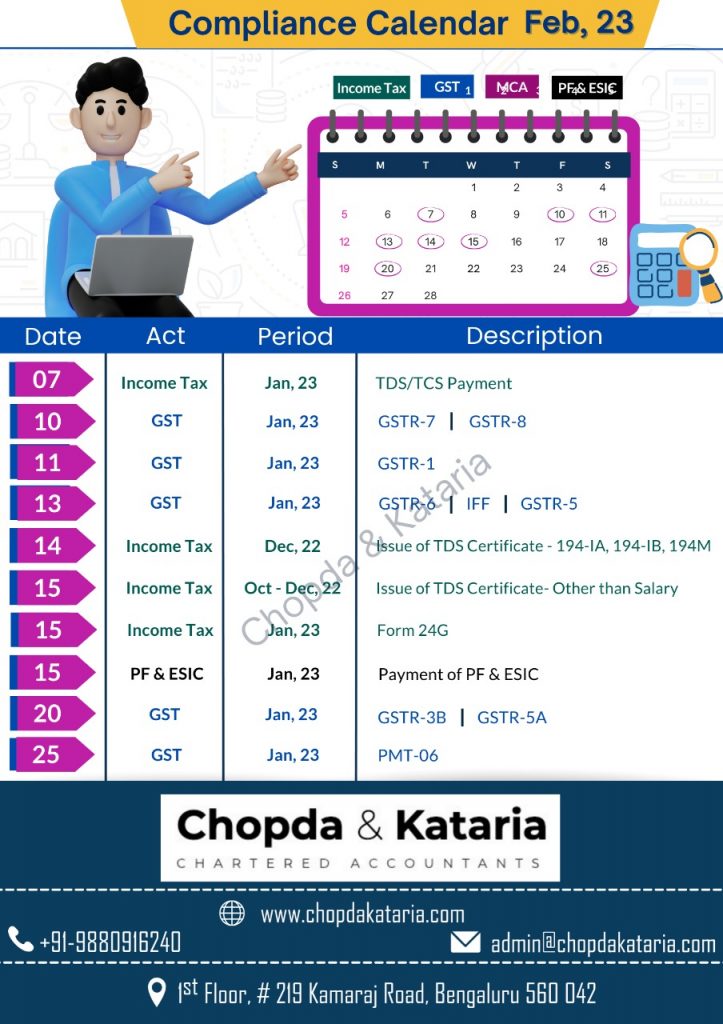

Compliance Calendar for February 2023

1. Negligent Accounting Practices

Most entrepreneurs will admit that they are not expert accountants. Yet, these same entrepreneurs try to handle their finances in house. This costly mistake forces startup founders to focus their attention on things like payroll and bank reconciliation rather than solely focusing on how to grow their business.

A trained professional will ensure your records are up to date, record transactions properly, and keep track of your accounts receivable and payable. This will allow you to spend your time and resources into expanding your business.

2. Mixing Business and Personal Finances

One of the most common accounting mistakes business owners make is to mix their business and personal finances. Keep these separate and distinct to provide a more precise track record of what was really used for business and what was specifically related to personal use only.

3. Accounting Software

When searching for the best accounting softwares, startups should look for the ones that serve their business objectives, are affordable and are easy to use for them. A business accounting software keeps your data organized and provides you the relevant information whenever you need it.

Choosing a good business software is a tedious task as it involves a lot of research on your part. This selection can make or break a business, as an accounting solution helps small businesses to take informed decisions. Being an startup you wouldn’t want a complex solution for your accounting operation.

At present, a lot of accounting solutions are available in India like Zoho, Quickbooks, etc. in the online model and Tally ERP 9, Marg, Busy, etc. in the offline mode.

4. Poor Record Keeping

When you ask owners of startups what their biggest problem is for their tax preparation and bookkeeping, there is one common answer that you will likely receive — tracking small expenses and finding lost receipts/challans/counterfoils etc.

Accounting is very time-consuming. The majority of startup owners are busy with business development as well as other essential functions, so when it comes to recording transactions — they have a tendency to procrastinate.

Not having an efficient system for filing documents also results in receipts getting lost. Proper documentation is necessary for CA audits and to generate accurate financial reports. Installing invoicing software of having small lock-up boxes throughout your work area can make it convenient to scan and save important receipts. Also, take the time to do periodic accounting and bookkeeping.

5. Confusion between employees and contractors

Many owners of startup businesses view taxes as something that only occurs at the end of their fiscal year. However, that overlooks other critical tax payments.

The majority of small business owners are confused about payroll tax preparation. They don’t understand the differences between employees and independent contractors/ professionals. If you fail to accurately calculate and pay the taxes you owe, you can be held liable and also be charged expensive fines. These problems can be prevented by becoming knowledgeable about the tax laws that relate to your business or you can hire an accountant or tax service in order to prevent heavy fines and losses.