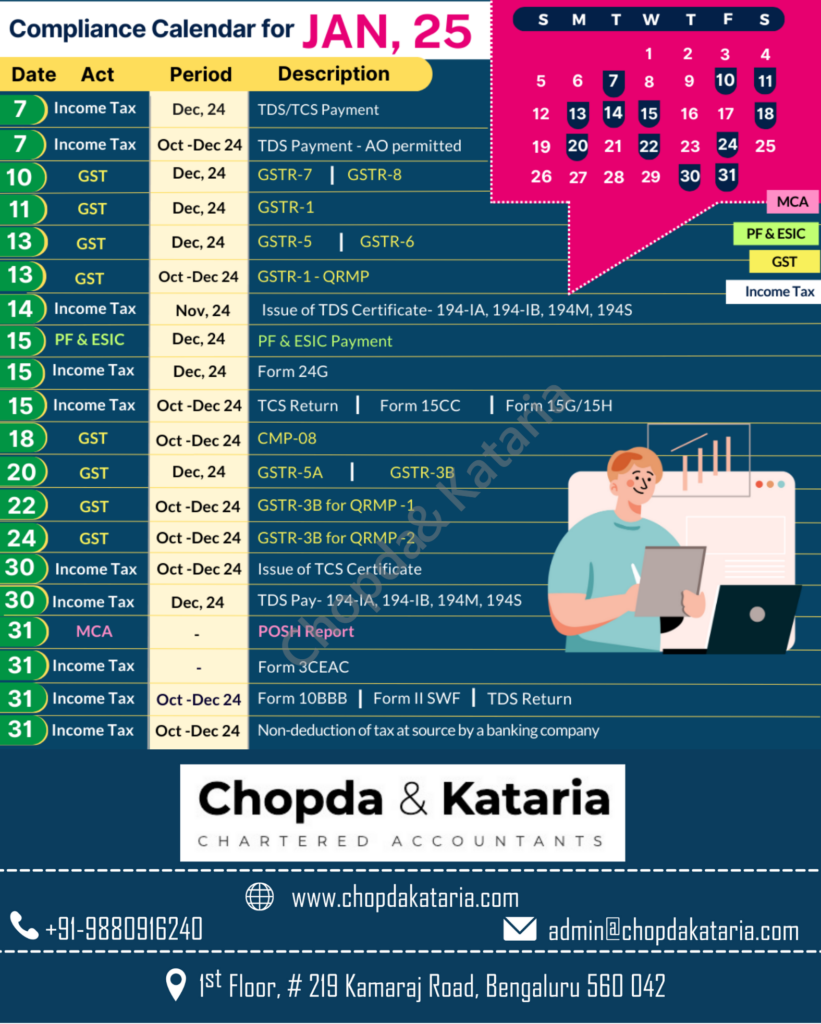

Compliance Calendar for January 2025

Penalty for Non-Disclosure of Foreign Assets/Income in Income Tax Return

Penalty for Non-Disclosure of Foreign Assets in Income Tax Return (ITR) 2024

The disclosure of foreign assets in Income Tax Returns (ITR) is a critical requirement under the Indian tax laws. This measure ensures transparency, deters tax evasion, and aligns with global initiatives like the Automatic Exchange of Information (AEOI). Non-disclosure of such assets can attract severe penalties and legal consequences under the Black Money (Undisclosed Foreign Income and Assets) and Imposition of Tax Act, 2015 (“Black Money Act”). Here’s an overview of the penalties for non-disclosure of foreign assets in ITR for the assessment year 2024-25 i.e. financial year 2023-24.

Key Requirements for Reporting Foreign Assets

Taxpayers qualifying as residents and ordinarily residents (ROR) under the Income-tax Act, 1961, are required to disclose details of their foreign assets and income in Schedule FA of the ITR. The disclosure includes:

- Foreign Bank Accounts: Account details, balances, and interest income.

- Immovable Property: Address, cost, and other particulars of foreign real estate.

- Financial Interest: Investments in foreign entities, shares, and other securities.

- Trusts or Entities: Beneficiary details in foreign trusts or entities.

- Any Other Asset: Such as intellectual property rights, deposits, and loans.

Penalties for Non-Disclosure

1. Under the Income-tax Act, 1961:

If a taxpayer fails to disclose foreign assets or income in the ITR, the following penalties may apply:

- Penalty for Misreporting:

If the non-disclosure results in underreporting of income, a penalty equal to 200% of the tax evaded may be levied under Section 270A. - General Penalty under Section 271:

For failure to furnish accurate particulars, a penalty of up to ₹10,000 can be imposed.

2. Under the Black Money Act:

The Black Money Act applies specifically to undisclosed foreign assets and income. Penalties include:

- For Non-Disclosure:

A penalty of up to ₹10,00,000 can be levied, irrespective of whether the taxpayer has taxable income from such assets. - Prosecution:

Non-disclosure of foreign assets can lead to imprisonment for 3 to 10 years, along with fines. - Tax Liability:

Undisclosed foreign income is taxed at a flat rate of 30%, without any exemptions or deductions. - Additional Penalty:

If an asset is deemed undisclosed under the Black Money Act, an additional penalty of three times the tax payable may be imposed.

Voluntary Disclosure to Avoid Penalties

Taxpayers who have inadvertently omitted foreign assets or income should consider making a voluntary disclosure. By filing a revised return before the due date or during scrutiny, the penalty exposure can be reduced, and prosecution avoided.

If foreign assets and income were not disclosed in the original return for FY 2023-24, they can be declared by filing a revised return before December 31, 2024.

Global Collaboration and Enhanced Enforcement

India’s participation in global tax transparency initiatives such as the Common Reporting Standard (CRS) has increased the government’s access to information on foreign accounts and assets. Non-compliance is likely to be detected due to automated information exchanges between countries.

Steps to Ensure Compliance

- Review Past Returns: Ensure foreign assets have been correctly disclosed.

- Consult Professionals: Engage tax professionals for accurate reporting.

- Maintain Records: Retain documentation supporting ownership, income, and valuation of foreign assets.

- Timely Filing: File ITR before the due date, avoiding late fees and interest.

Conclusion

The penalties for non-disclosure of foreign assets are stringent, reflecting India’s commitment to combating black money and tax evasion. Taxpayers must be vigilant about reporting their foreign holdings to avoid penalties and comply with domestic and international laws. As global scrutiny increases, adhering to disclosure norms is not just a legal obligation but also a prudent financial practice.

Highlights of Budget 2023

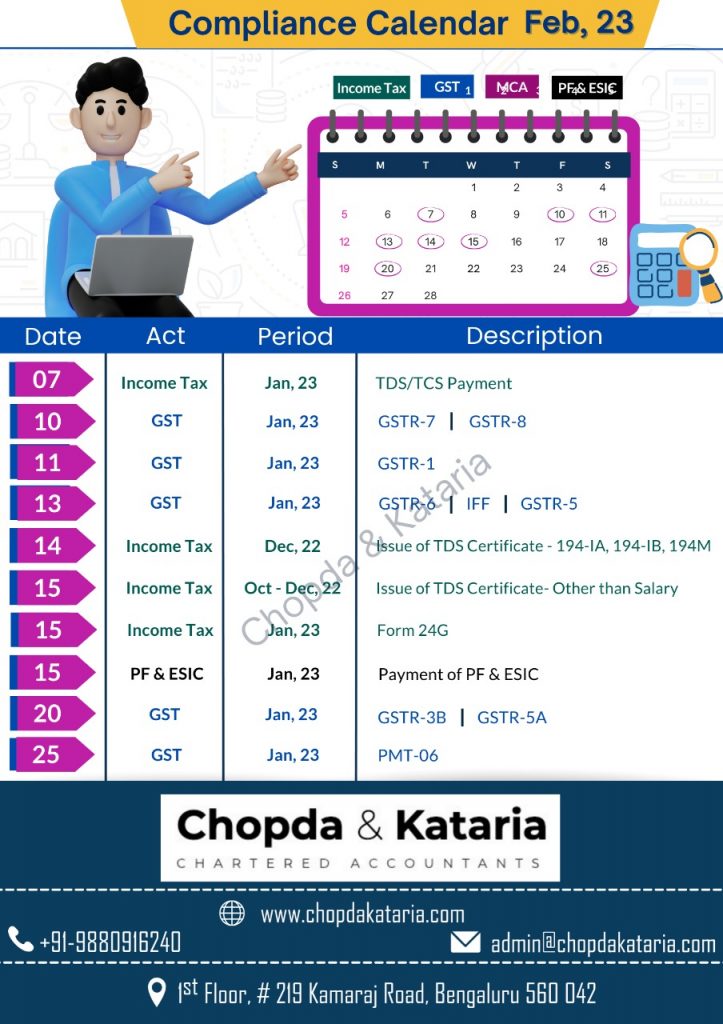

Compliance Calendar for February 2023

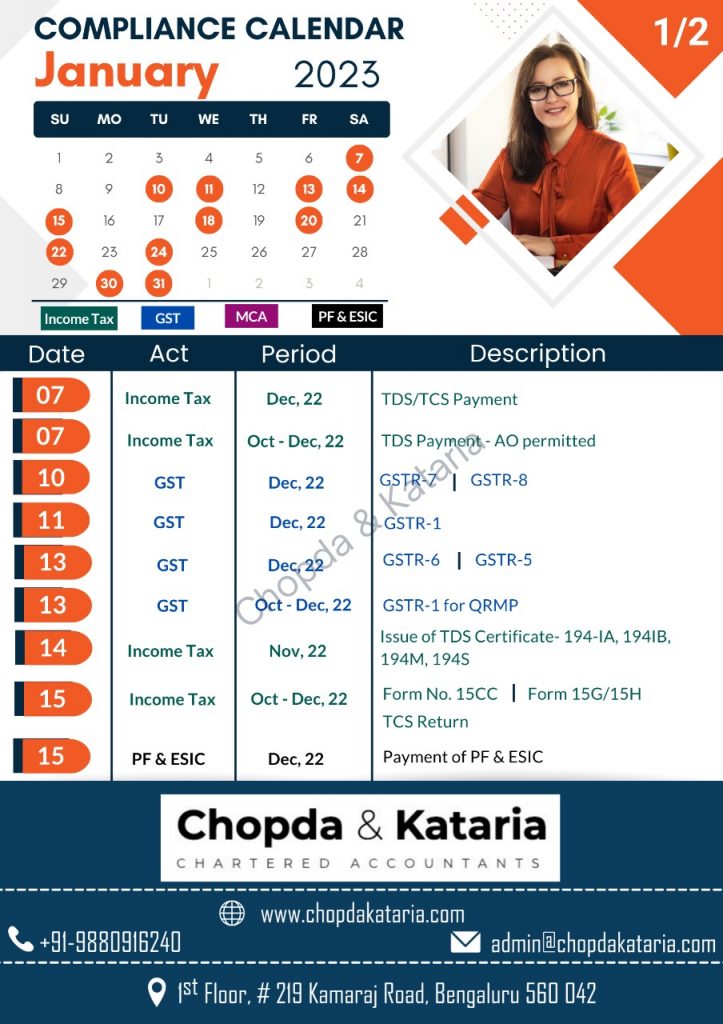

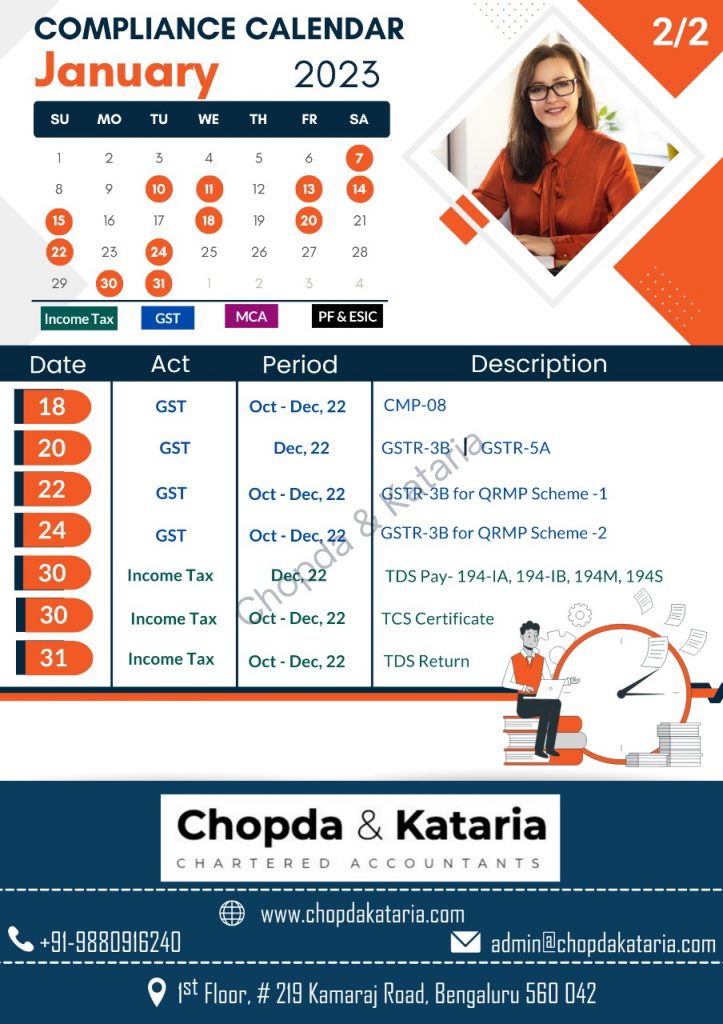

Compliance Calendar for January 2023

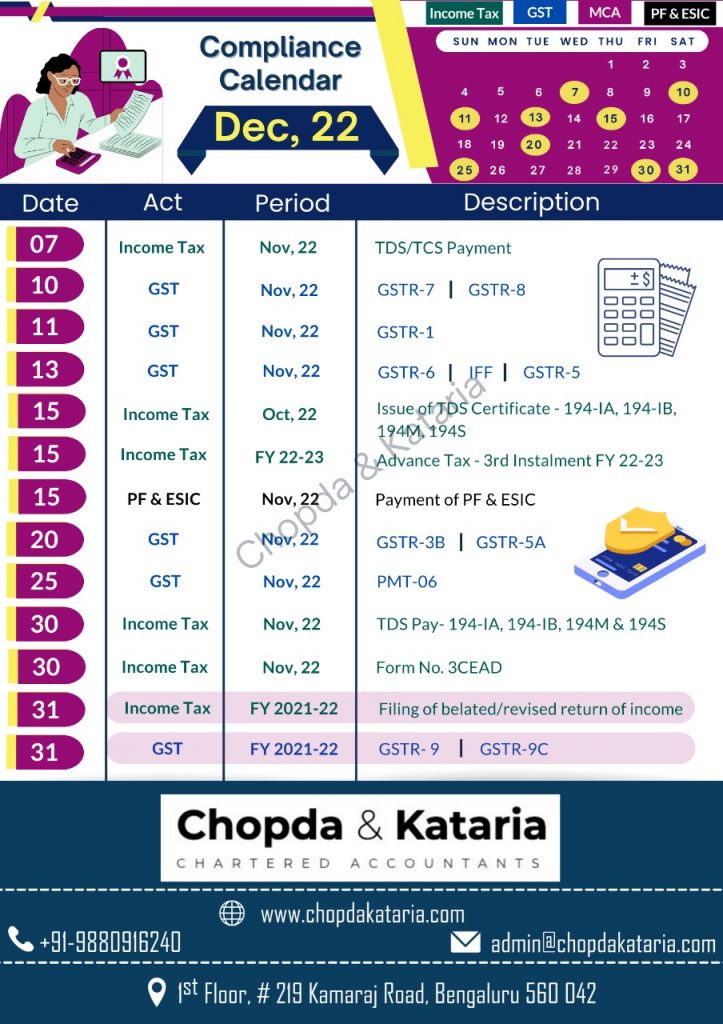

Compliance Calendar for December 2022

TDS Rates and Limits for FY 2022-23 / AY 2023-24

Please find below a pdf file containing the TDS rates and limits applicable for FY 2022-23/ AY 2023-24.

How to deal with the assessment order passed levying huge tax liabilities, interest and penalty?

Huge add-backs in assessment order? An exemption claim not given? Taxes and interest computed erroneously? Should we file an appeal or not? Penalty order received – wondering what to reply? The order passed in not just and fair?

Are any of these worrying you?

Don’t panic with the huge add-backs, taxes, interest, or penalties raised. Many times orders are passed without considering the facts and law in detail. Many facts and aspects of the law are hidden and if not appropriately pointed out before the tax authorities could lead to orders that are prejudicial to one’s interest. There is more than one remedy available to the taxpayer based on the type of order.

Assessment orders

The orders passed levying huge taxes, interest, etc. could be broadly on account of two reasons:

- Computational errors.

- Disputed issues at hand.

- Computational errors – If the order passed has a mistake that is apparent on record the taxpayer can file a rectification application u/s 154 for the same and need not go for an appeal if there are no disputed issues at hand.

A mistake apparent on record means any mistake which is obvious and patent. The plain meaning of the word “apparent” is that it must be something that appears to be so ex-facie and is incapable of argument or debate. It could be factual errors, mathematical errors, clerical errors, and involuntarily overlooking certain compulsory legal provisions. E.g., the tax percentage taken is erroneous, interest is not computed as per the provisions of the Act, TDS credit has not been given, taxes paid are not considered, deduction, allowance, or relief which is accepted by the officer but overlooked while computing, etc.

Against such mistakes, a rectification application can be filed online u/s 154 and relief be claimed for erroneous computations in the assessment order.

- Disputed issues at hand – if there are issues in the assessment order which are disputed, the remedy in the hands of the taxpayer is to file an appeal with the Commissioner of Appeal in Form 35 within 30 days from the passing of the order. However, for reasons beyond control, an appeal can be filed even after 30 days by filing a condonation of delay application.

How to judge whether one should go for an appeal or not?

The usual errors while passing the Assessment order which could give scope for a good argument and become a significant point in the appeal are as below:

- The order was not passed within the time limit prescribed under the Income Tax Act.

- The order was passed without giving a proper opportunity of being heard.

- Where e- submissions couldn’t be made for technical glitches in portal.

- The video conferencing option requested was not granted.

- The order was passed without giving a prior show cause notice to submit documents or evidence supporting the issues raised by the Assessing Officer.

- The order has been passed by the assessing officer ignoring the facts and documents submitted before them.

- The order passed does not clearly pronounce the issue at hand and has just added back income as unexplained.

- The issue at hand has two opinions and a favorable opinion has been ignored.

- Binding judicial precedents have not been considered while passing the order.

- Additional evidences are present which could not be submitted before the Assessing officer but are crucial in deciding the case at hand.

- Recent amendments/notifications/circulars have not been considered while passing the order.

There could be many such issues, one must take expert advice before filing an appeal to decide whether it’s a fit case to proceed or not.

Form 35 – Crucial Points to be considered

- Prepare a brief Statement of facts covering all facts of the case and also state the facts that are ignored by the assessing officer

- Grounds of appeal – this should ideally cover all the objections raised both from a law and facts perspective with quoting of sections wherever applicable.

- 20% of the disputed demand needs to be paid upfront at the time of filing an appeal.

- Appeal filing fee needs to be remitted before uploading the Form 35.

- Additional evidences if any, which were not submitted before the Assessing officer needs to be mentioned in the statement of facts and in Form 35.

- If an appeal is not filed within the time limit, a condonation application is to be enclosed.

Though the form 35 is available on the portal and one can directly file an appeal, it is always advisable to take professional support as there are many precautions that need to be exercised to avoid further issues while representing the case.

Penalty orders

The penalty orders received need to be responded to within the time limit otherwise huge penalty would be levied. Penalty could be for various reasons such as not filing of returns, non-audit of books of accounts, default in TDS/TCS remittances if income has escaped assessment or contravention of loan provisions etc.

The penal provisions under the Act are very stringent, but irrespective of it the taxpayer will be given an adequate chance to represent and submit all documents and evidence so as to justify why the penalty should not be received.

One should clearly see which section is applicable and what are the conditions to levy penalty under that section. Based on the facts and law one can represent why the penalty should not be levied. Further in cases of genuine hardship caused to the taxpayer one can try to reduce the penalty amount by taking the support of many judicial precedents.

Conclusion

One should not panic looking at the orders passed and taxes levied. Instead, patiently look for points both factually and legally which could justify and get the rightful claim to you. There are various remedies available at the hand of a taxpayer. One needs to exercise the options at the right time and in the right manner to protect their interest.

EXTENSION OF TIME LIMITS OF CERTAIN COMPLIANCES UNDER INCOME TAX ACT- REF CIRCULAR NO.9/2021 DATED 20TH MAY 2021.

The Central Board of Direct Taxes, in the exercise of its power under section 119 of the Income-tax Act, 1961 (hereinafter referred to as “the Act”) provides relaxation in respect of the following compliances:

- The Statement of Financial Transactions (SFT) for the Financial Year 202021, required to be furnished on or before 31st May 2021 under Rule 114E of the Income-tax Rules, 1962 (hereinafter referred to as “the Rules”) and various notifications issued thereunder, may be furnished on or before 30th June 2021;

- The Statement of Reportable Account for the calendar year 2020, required to be furnished on or before 31st May 2021 under Rule 114G of the Rules, may be furnished on or before 30th June 2021;

- The Statement of Deduction of Tax for the last quarter of the Financial Year 2020-21, required to be furnished on or before 31st May 2021 under Rule 31A of the Rules, may be furnished on or before 30th June 2021;

- The Certificate of Tax Deducted at Source in Form No 16, required to be furnished to the employee by 15th June 2021 under Rule 31 of the Rules, may be furnished on or before 15th July 2021;

- The TDS/TCS Book Adjustment Statement in Form No 24G for the month of May 2021, required to be furnished on or before 15th June 2021 under Rule 30 and Rule 37CA of the Rules, may be furnished on or before 30th June 2021;

- The Statement of Deduction of Tax from contributions paid by the trustees of an approved superannuation fund for the Financial Year 2020-21, required to be sent on or before 31st May 2021 under Rule 33 of the Rules, may be sent on or before 30th June 2021;

- The Statement of Income paid or credited by an investment fund to its unit holder in Form No 64D for the Previous Year 2020-21, required to be furnished on or before 15th June 2021 under Rule 12CB of the Rules, may be furnished on or before 30th June 2021;

- The Statement of Income paid or credited by an investment fund to its unit holder in Form No 64C for the Previous Year 2020-21, required to be furnished on or before 30th June 2021 under Rule 12CB of the Rules, may be furnished on or before 15th July 2021;

- The due date of furnishing of Return of Income for the Assessment Year 2021-22, which is 31st July 2021 under sub-section (1) of section 139 of the Act, is extended to 30th September 2021;

- The due date of furnishing of Report of Audit under any provision of the Act for the Previous Year 2020-21, which is 30th September 2021, is extended to 31st October 2021;

- The due date of furnishing Report from an Accountant by persons entering into international transaction or specified domestic transaction under section 92E of the Act for the Previous Year 2020-21, which is 31st October 2021, is extended to 30th November 2021;

- The due date of furnishing of Return of Income for the Assessment Year 2021-22, which is 31st October 2021 under sub-section (1) of section 139 of the Act, is extended to 30th November 2021;

- The due date of furnishing of Return of Income for the Assessment Year 2021-22, which is 30th November 2021 under sub-section (1) of section 139 of the Act, is extended to 31st December 2021;

- The due date of furnishing of Return of Income for the Assessment Year 2021-22, which is 30th November 2021 under sub-section (1) of section 139 of the Act, is extended to 31st December 2021;

Clarification 1: It is clarified that the extension of the dates as referred to in clauses (9), (12) and (13) above shall not apply to Explanation 1 to section 234A of the Act, in cases where the amount of tax on the total income as reduced by the amount as specified in clauses (i) to (vi) of sub-section (1) of that section exceeds one lakh rupees.

Clarification 2: For the purpose of Clarification 1, in case of an individual resident in India referred to in sub-section (2) of section 207 of the Act, the tax paid by him under section 140A of the Act within the due date (without extension under this Circular) provided in that Act, shall be deemed to be the advance tax.